Project type

Product concept & UX exploration

Problem space

High-volume expense management and policy enforcement

Users

Employees, people managers, finance teams

Role

Lead designer exploring product direction, workflows, and AI opportunities

Context

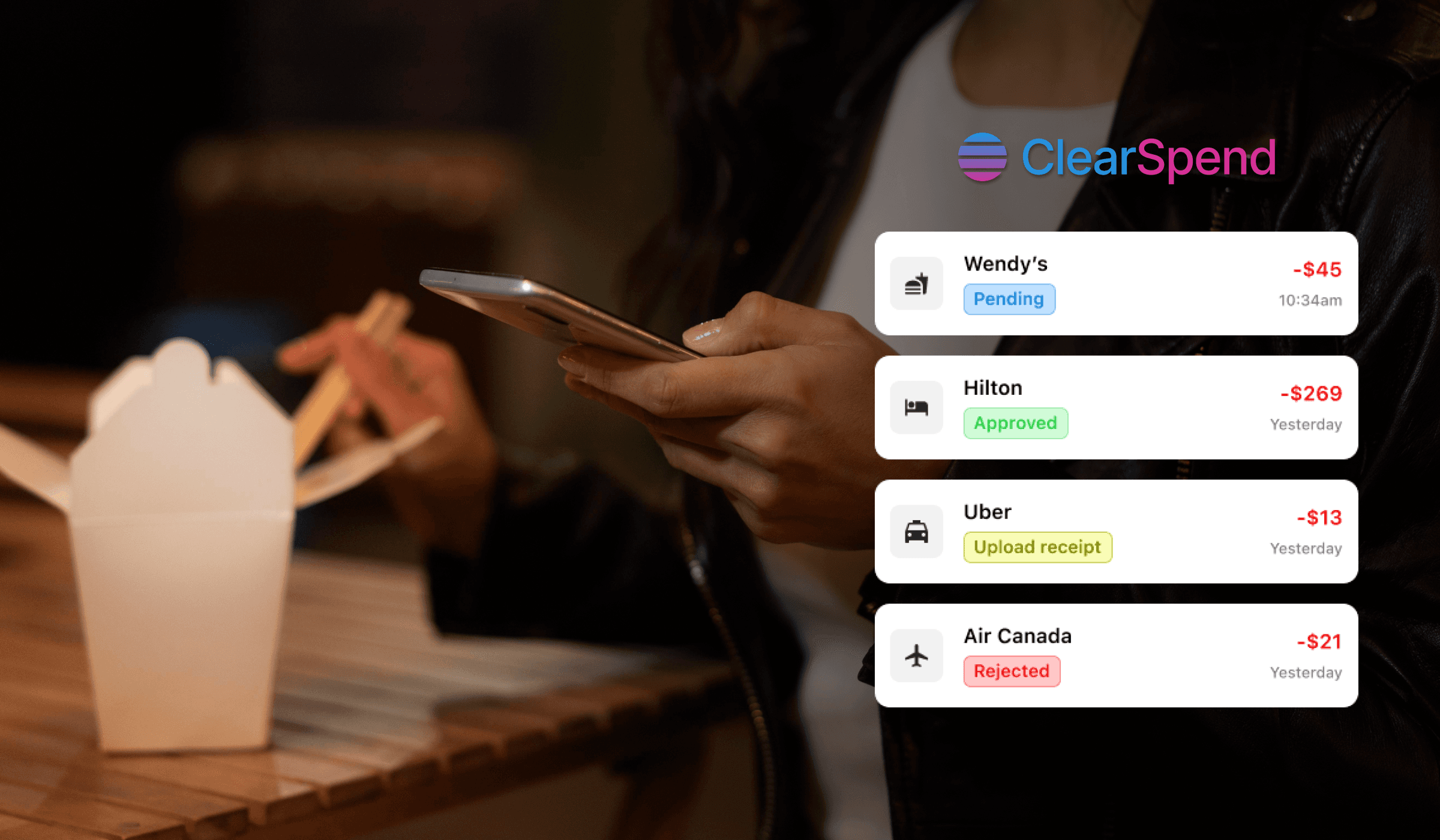

This project explores how AI-assisted workflows can improve expense review, approval, and compliance for employees, managers, and finance teams.

The work focuses on designing scalable UX patterns for high-volume expense management, emphasizing clarity, exception handling, and decision confidence for different user roles.